VMware Licensing Changes Post-Broadcom Acquisition: Strategies for CIOs and Procurement Teams

Broadcom’s acquisition of VMware has introduced significant changes to VMware’s licensing model, affecting enterprises across all industries.

CIOs and procurement leaders face steep cost increases, a shift from perpetual to subscription licensing, and reduced flexibility in purchasing and supporting VMware products.

Organizations that long relied on perpetual VMware licenses with predictable support renewals are now pressured to adopt new subscription bundles.

They often pay for features they do not need, which can multiply costs several times.

This article outlines Broadcom’s key challenges in its new licensing approach and presents high-level strategies to mitigate their impact.

It offers guidance on:

- Gaining clarity on Broadcom’s new VMware licensing model and its business impact

- Effective negotiation tactics to contain costs under the new regime

- Optimizing current VMware deployments to reduce licensing spend

- Exploring alternative virtualization platforms to reduce reliance on VMware

- Leveraging hybrid and multi-cloud strategies to increase flexibility and avoid lock-in

- Partnering with third-party service providers or resellers for cost-effective support and solutions

- Considering legal and contractual angles for enterprises with existing VMware agreements

Enterprises can navigate these changes by taking a proactive, strategic approach and controlling their IT budgets and architectures. Early planning and informed decision-making are crucial – waiting until renewal time could leave the organization with few options and little leverage.

In the following sections, we discuss the challenges in detail and recommend actionable strategies for CIOs and procurement teams to consider.

Key Challenges After Broadcom’s VMware Licensing Changes

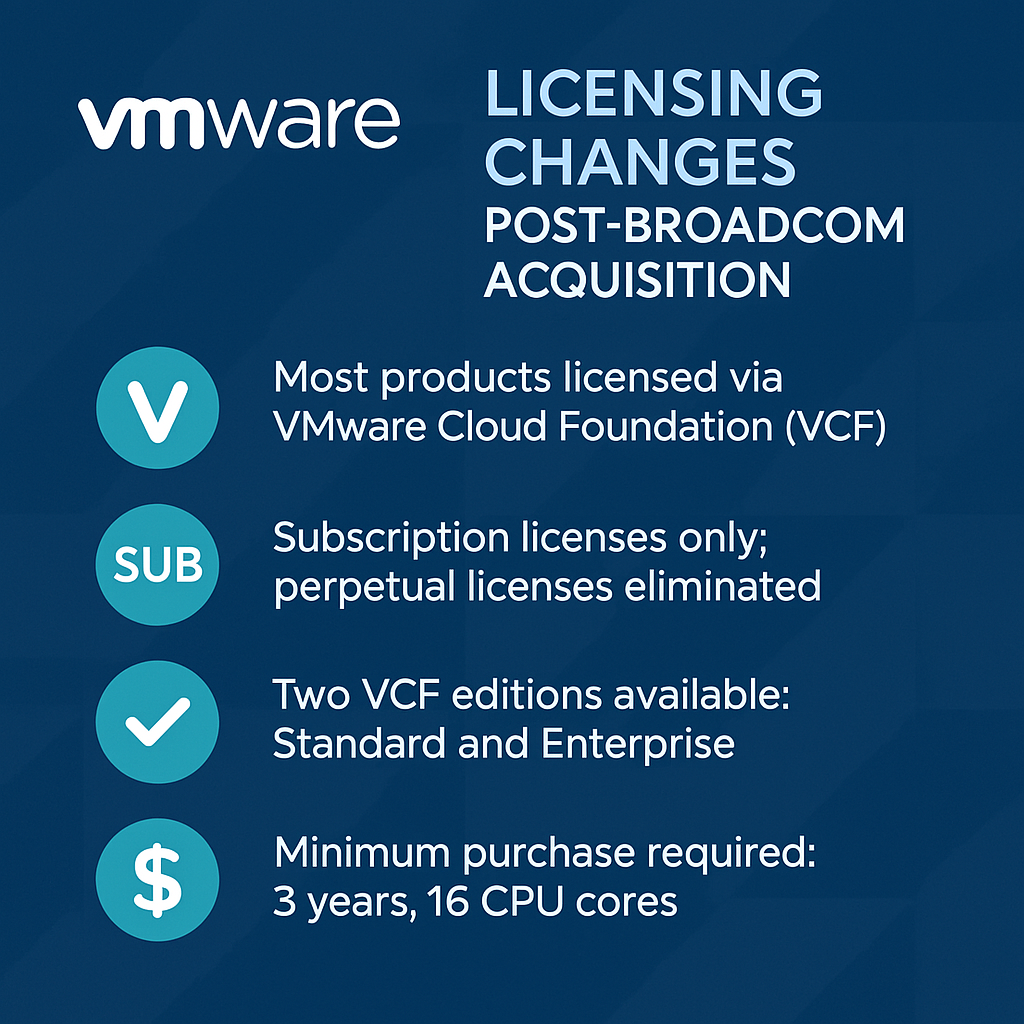

Broadcom’s New Licensing Model – Subscription-Only and Bundled Offerings: VMware, now a Broadcom division, is consolidating over 160 products into a few bundled solutions and has moved from perpetual licenses to per-core subscription licenses.

Effective in 2023, new perpetual license sales and support renewals were halted, meaning customers can no longer renew maintenance on existing perpetual licenses. Enterprises must subscribe to the new “VMware by Broadcom” bundles (such as VMware Cloud Foundation or vSphere Foundation) to receive updates and support.

This bundling often forces customers to pay for components they previously purchased à la carte, reducing flexibility and potentially leaving organizations paying for features they don’t use.

Additionally, Broadcom introduced a strict “license per core” model with a minimum of 16 cores per CPU, which can inflate costs for modern multi-core servers. These changes represent a monumental shift in how VMware technology is acquired and managed.

Steep Cost Increases and Budget Impact: Many organizations are experiencing sticker shock at renewal time. Broadcom’s pricing strategy has led to reports of renewal cost increases ranging from three to ten times what enterprises previously paid.

Such dramatic hikes can upend IT budgets, turning what was once a largely CapEx one-time license purchase into a significant ongoing OpEx commitment. CIOs and CFOs are now forced to reallocate funds to cover these unplanned expenses, potentially at the expense of innovation initiatives.

The shift to subscriptions is intended to provide predictable spending over time; however, in practice, many customers experience higher total costs and less pricing flexibility compared to the perpetual model.

This immediate and substantial financial impact requires new budgeting strategies and cost optimizations.

Forced Timing and Product Transitions:

Broadcom aggressively pushes customers to make quick transitions. Enterprises still on perpetual licenses are being transitioned to the new VMware Cloud Foundation (VCF) or vSphere Foundation (VSF) subscriptions, regardless of their readiness or actual needs.

In many cases, renewals are being forced on Broadcom’s timeline—some customers report being given only weeks to decide on subscription renewals, under the threat of having their supportlapse.

If a customer delays, Broadcom has shown a willingness to use software compliance audits as leverage, creating a risk of costly penalties for any licensing shortfalls.

This tactic leaves customers feeling they have little choice but to accept Broadcom’s terms quickly.

Furthermore, simplifying VMware’s portfolio means that certain standalone products, such as vSAN, NSX, and Site Recovery Manager, are no longer sold individually and must be obtained as part of broader bundles.

This can disrupt IT plans as organizations scramble to adjust to new product combinations and potentially accelerated upgrade and migration projects.

Reduced Partner Ecosystem and Support Changes:

Broadcom has significantly restructured VMware’s channel and support ecosystem. Legacy VMware reseller agreements (including OEM deals with server vendors) were terminated or replaced, eliminating many historical discounts and incentives.

Broadcom now prefers to engage directly with the largest 2,000 customers and has pruned its partner network, meaning many customers have lost their traditional reseller or account manager advocates.

This loss of channel flexibility removes a layer of negotiation buffer and personalized support that enterprises used to enjoy.

Customers now often must deal directly with Broadcom’s sales teams, which have a reputation for a “take-it-or-leave-it” stance and rigid terms.

At the same time, Broadcom’s integration of VMware’s support has raised concerns about the quality and responsiveness of the support.

With fewer support options (since using VMware without an active subscription means no official support or updates), enterprises are wary of being locked into a single-vendor support channel that may not meet their expectations.

Uncertain Roadmap and Lock-In Concerns:

The upheaval has also created strategic uncertainty. Broadcom’s focus on a narrower set of offerings, including VCF and VVF bundles, as well as the potential sale or spinoff of certain VMware divisions, such as the End-User Computing portfolio, has left customers questioning the future of some VMware products.

There is concern that innovation may slow as Broadcom seeks quick returns on its $69 billion investment, potentially leaving customers paying more without clear enhancements. Some observers cite Broadcom’s history with CA and Symantec as cautionary examples.

Many CIOs now worry about over-reliance on VMware in their stack, fearing vendor lock-in under less favorable terms. These challenges compel organizations to reassess their virtualization and cloud strategies in a holistic manner.

In summary, due to Broadcom’s changes in VMware licensing, enterprises face higher costs, pressured timelines, and fewer options. The following strategies address mitigating these challenges, from shoring up your position with Broadcom to exploring alternatives while maintaining business continuity.

Recommended Strategies for Navigating the Licensing Changes

CIOs and procurement teams should take a multi-pronged strategic approach to respond effectively. The goal is to regain leverage, control costs, and ensure flexibility in the face of Broadcom’s new model.

Below are key strategies to consider:

1. Broadcom’s New Licensing Model and Its Impact

Knowledge is power—thoroughly understanding Broadcom’s new licensing and how it affects your organization.

Then, engage with Broadcom or authorized partners to clarify the changes to your current agreements.

Key actions include:

- Map Your Current Licenses to the New Model: Inventory all VMware products and licenses you own. Determine how each maps to Broadcom’s new bundles or subscription editions. This will reveal which licenses might become redundant or bundled together. VMware’s shift means, for example, that vSphere and vSAN are now sold only as part of larger solutions. Understanding these mappings will help you identify areas where you may incur additional costs and pinpoint gaps or overlaps in functionality.

- Analyze Cost Impacts: Evaluate how the new per-core subscriptions will change your spending. Calculate scenarios for your deployments under subscription licensing, including core counts, support levels, and other relevant factors, and compare them to your previous costs. Pay attention to minimum core counts and bundled components that could drive costs higher. For instance, the per-core model could significantly increase the number of licensing units needed if you have servers with a high core density. Broadcom has offered some initial incentive discounts (e.g., 50% off early trade-in credits for switching to a subscription) – inquire if these programs are still available and factor them into your decision. However, please note that the list pricing will apply after any promotional period at your next renewal.

- Identify At-Risk Areas: Determine which aspects of your IT environment are most affected. Are mission-critical systems running on VMware products that are now end-of-sale or require a bundle purchase? If you rely on a single VMware product that is now part of Cloud Foundation, you may be forced to purchase more than you need. Similarly, note any upcoming support contract expirations for perpetual licenses – once this expires, you must transition to a subscription or lose official support and updates. This analysis will help prioritize your response and justify any proactive investments or changes.

Fully grasping Broadcom’s model and its implications can better prepare your organization. This understanding not only informs cost planning but also strengthens your position in any negotiations by removing uncertainty.

2. Strengthen Negotiation Tactics with Broadcom

Facing a vendor known for tough negotiations, enterprises must approach VMware renewal talks clearly and strategically.

Broadcom recognizes that switching away from VMware can be challenging for most customers and may initially offer limited flexibility.

Even so, there are tactics that can improve your outcome:

- Consolidate and Leverage Your Spend: If possible, bundle your VMware requirements into a single negotiation to maximize your savings. Broadcom is more likely to consider discounts or concessions for larger, multi-year commitments. Highlight the total value of your business (across VMware products) and be prepared to discuss a longer contract term or expanded usage in exchange for price protection. For example, negotiating a 3- to 5-year enterprise agreement for VMware subscriptions could secure a better rate and guard against further increases during that term. Ensure that any multi-year deal includes price caps or rate locks to avoid unexpected price hikes.

- Seek Transitional Incentives: Inquire about promotional programs or trade-in deals. Broadcom initially offered aggressive incentives, such as over 50% off, for customers trading perpetual licenses for subscriptions. If you still have perpetual licenses, use them as bargaining chips – ask Broadcom to honor or extend such incentives. Take advantage of trade-in offers sooner rather than later, as these are unlikely to last. This can soften the financial blow of the first renewal under the new model.

- Align Negotiation Timing with Your Planning: Initiate renewal conversations at least 4-6 months before your deadline to allow sufficient time to maneuver. Broadcom has pressured clients to renew quickly by setting short response windows. By engaging early, you reduce the chance of last-minute ultimatums. Use this time to complete internal assessments (as described in the next strategy), so you enter discussions with hard data on your usage and needs.

- Demonstrate a Willingness to Explore Alternatives: Even if a full switch is not imminent, it’s clear that you have options. Broadcom may be more flexible if they sense the risk of losing your future business. Reference any pilot projects or evaluations your organization is doing with other platforms (without bluffing dishonestly). The knowledge that competitors are offering “take-out” programs to lure VMware customers can be used to underline that you will consider moving new workloads elsewhere if VMware’s terms are unsustainable. A credible Plan B strengthens your negotiating stance.

- Involve Executive Sponsors: Given the scale of cost increases, negotiating with Broadcom may require escalation to higher levels of management. Engage your C-suite and even Broadcom’s senior management if necessary. As a top customer, you can request executive-level meetings to negotiate favorable terms or seek clarity on future roadmap commitments. Broadcom is focusing on its largest clients, so use that to your advantage by insisting on flexible payment options or phased adoption plans for large deployments. Having CIO/CFO visibility in these talks also signals to Broadcom that the issue is a high priority for your company.

While Broadcom’s stance is reportedly rigid, combining these tactics can yield some concessions.

At a minimum, you can secure time to transition and avoid punitive measures. Remember that delaying without a strategy is risky – if Broadcom perceives reluctance, they may initiate an audit.

So, come prepared, lead the conversation, and ensure you negotiate from a position of knowledge (e.g., based on the license audits in the next section) rather than reacting under duress.

3. Optimize Current VMware Deployments to Reduce Licensing Costs

Optimizing your VMware footprint is one of the most effective ways to counter rising costs.

Tuning what you have, directly cutting costs, or freeing the budget to reinvest often reduces the number of licenses or support subscriptions required.

Key optimization steps include:

- Conduct a Comprehensive License Audit (License Position Assessment): Perform an internal audit of your VMware environment to get a detailed picture of license usage and needs. A License Position Assessment (LPA) process helps map your current deployments against VMware’s new licensing structure. The audit should identify which licenses are active, underused, or unused. Many organizations discover they are over-provisioned – for example, virtual machines (VMs) running on hosts with spare capacity or features enabled that are not utilized. An LPA educates your team on how your products translate to the new bundles, right-sizes your usage (e.g., optimizing core counts per host), and checks compliance to avoid audit penalties. Knowing exactly what you have ensures you don’t overpay for subscriptions that cover unused resources. It also prepares you to defend against any Broadcom compliance audit with confidence in your data.

- Right-Size and Reclaim Resources: Use the audit findings to take action. Decommission or reassign underutilized licenses – for instance, shut down unused VMs and consolidate workloads so that you can reduce the number of ESXi hosts (thus needing fewer vSphere licenses). Optimize VM density per host to maximize the 16-core licensing chunks per CPU. If some environments, such as test/dev clusters, can tolerate less capacity, consider lowering the core counts or powering them on only when needed to minimize license usage. Eliminate non-compliant deployments or ‘shelfware’ that could expose you to fees. This rightsizing can significantly offset the increased unit costs by reducing the number of required licenses.

- Optimize Support Levels and Renewal Scope: Review the support contracts attached to your VMware licenses. Broadcom’s new bundles might include higher support tiers by default, so determine if that aligns with your needs or if you’re paying for premium support unnecessarily. If certain VMware components are not mission-critical, you may choose lower-cost support (if available) or consider keeping a few non-essential hosts on older versions without a subscription while migrating their workloads elsewhere over time. Additionally, synchronize renewal dates and consolidate contracts whenever possible. Having a single unified renewal date can simplify management and strengthen your negotiating position, preventing forgotten licenses from auto-renewing at high rates.

- Technical Optimization for Cost Efficiency: Work with your IT teams to ensure the VMware environment is technically optimized, as this directly affects licensing needs. For example, adjust your cluster designs to fully utilize hardware – a poorly optimized cluster might use 10 hosts at 50% capacity each. In contrast, a tuned one might use six hosts at ~85%, saving four host licenses. Ensure each physical CPU is populated with as close to 16 cores (or a multiple thereof) as possible to avoid “wasted” cores beyond the licensing threshold. Use VMware’s tools, such as vRealize Operations or third-party utilities, to identify waste (over-provisioned vCPUs, idle VMs, etc.) and reclaim those resources. Every CPU core or gigabyte of RAM you can eliminate from unused allocations is potentially a cost-saving under subscription metrics. In short, treat VMware licenses as a finite resource to be carefully managed and optimized, much like you would cloud resources in a public cloud deployment.

By optimizing and rightsizing, enterprises have reported material savings that mitigate the impact of Broadcom’s pricing. These efforts not only cut costs but also improve your operational efficiency.

Moreover, demonstrating a lean and well-managed deployment can be advantageous in negotiations – it shows Broadcom that your “wallet” is not open-ended and that you can and will reduce spending if prices are unreasonable.

In some cases, companies have even delayed immediate upgrades or purchases (“buy time”) by maximizing current assets, giving them breathing room to plan the next steps.

4. Explore Alternative Virtualization Platforms

Organizations should assess alternative virtualization and cloud platforms to reduce dependence on VMware and gain leverage.

Broadcom’s moves have spurred competitors to offer attractive options, and modern infrastructure trends provide multiple viable paths.

At a high level, consider two categories of alternatives:

- Alternate Hypervisor Solutions: Evaluate other enterprise hypervisors and software-defined infrastructure stacks. Major players like Microsoft Hyper-V, Red Hat (KVM), Nutanix AHV, and Citrix XenServer can often meet core virtualization needs at a lower cost or with more favorable licensing terms. Each alternative has its own ecosystem and feature set, so assess them against your requirements, such as performance, management tools, and existing skill sets. Some vendors actively target VMware customers by offering competitive migration programs or tools to convert VMware workloads. If you have a significant Windows Server footprint, Hyper-V or Azure Stack might integrate well. If you favor open source, KVM-based solutions or OpenStack could provide flexibility. Conduct a proof-of-concept or pilot with a small subset of workloads on a chosen alternative to assess its feasibility. Remember that migrating hypervisors is a non-trivial effort that could take months or years for large estates. However, even taking the initial steps toward an alternative can strengthen your negotiating hand and reduce VMware’s footprint.

- Cloud and Container Platforms (Modernization): The industry’s shift toward cloud and containerization provides another way to decrease VMware’s reliance. Consider whether some applications can be re-platformed to cloud-native environments or managed with container services (such as Kubernetes) instead of running on VMware VMs. Many enterprises are embracing hybrid and multi-cloud setups, where part of the workload runs on public clouds (AWS, Azure, GCP, etc.) using cloud-native services, bypassing the need to expand on-premises VMware infrastructure. VMware’s cloud offerings, such as VMware on AWS, are now also sold through Broadcom. So, weigh the benefits carefully – they may not provide cost relief if Broadcom controls the pricing. Alternatively, deploying a private cloud based on open-source technologies (for instance, Kubernetes or OpenStack on bare metal) could be a strategic long-term move to eliminate dependency on VMware’s stack. This is a more radical change, but it aligns with trends toward containerization and can unify your infrastructure under a more cost-effective model if done right.

As noted in the next section, creating a transition roadmap is crucial to avoid disruption when exploring alternatives. Not all workloads may be suitable for immediate migration; however, migrating a portion of your estate to an alternative platform can yield savings and reduce risk. For example, some organizations offload non-critical or new development workloads to a different platform.

Others leverage the cloud for burst or disaster recovery scenarios instead of expanding VMware capacity.

By diversifying your virtualization portfolio, you gain bargaining power and technological flexibility. Additionally, being well-versed in the competitive landscape enables you to make a strong internal case and inform Broadcom that you will not be “locked in” at any cost.

The mere presence of a credible alternative can often motivate a vendor to be more reasonable. Over the longer term, a multi-platform strategy might emerge where VMware is used where it adds unique value and other platforms are used elsewhere to optimize cost and performance.

5. Leverage Hybrid and Multi-Cloud Strategies

A hybrid or multi-cloud strategy can be a powerful way to mitigate licensing risks and optimize costs.

Instead of keeping all workloads on VMware in your data centers, consider a more flexible deployment across various environments:

- Right Workload, Right Environment: Revisit your cloud strategy to determine which workloads should run on-premises on VMware and which could run in the public cloud or as SaaS. Many organizations are shifting toward a hybrid approach that blends on-premises private clouds with public cloud services for greater agility. For example, you might keep legacy systems or data-sensitive workloads on a private VMware cloud but migrate certain applications to a public cloud platform where you can take advantage of native services or more favorable economics. By doing this, you can scale down your VMware footprint to the capacity you need on-prem, avoiding over-investment in VMware licenses for peaks that can be handled in the cloud.

- Multi-Cloud to Avoid Single-Vendor Lock-In: Even if you use VMware in the cloud (e.g., VMware Cloud on AWS, Azure VMware Solution), balance it with other cloud environments. Adopt a multi-cloud strategy for distributing workloads across multiple cloud providers (e.g., AWS, Azure, Google) and your on-premises setup. This provides resilience and choice, meaning no vendor can dictate all the terms. If Broadcom’s VMware pricing becomes untenable, having some workloads running on alternate platforms (like AWS EC2, Azure VMs, or containers) gives you the flexibility to shift more workloads in that direction. Essentially, multi-cloud strategies hedge against being overly dependent on VMware’s ecosystem. They also allow you to select the optimal environment for each application. For instance, data analytics may be more cost-effective on the public cloud, while an ERP system might remain on a private cloud due to compliance requirements.

- License Portability and Hybrid Use: Broadcom/VMware has introduced a bring-your-own-subscription model for hybrid cloud, which allows for some license portability between on-premises and certain VMware-based cloud endpoints. If you plan to stick with VMware, ensure you architect a hybrid cloud in a way that takes advantage of this portability. That way, the same subscription entitlements can cover your private data center and VMware-based public cloud deployments, maximizing utilization. Also, consider using short-term cloud capacity (via VMware Cloud or other IaaS) during bursts or migrations instead of expanding permanent on-premises VMware licenses.

- Modernize and Optimize for Cloud Economics: Embracing hybrid or multi-cloud often goes hand in hand with modernizing applications, such as breaking monoliths into microservices and using containers. This can yield cost benefits by enabling cloud auto-scaling, pay-as-you-go models, and more granular resource use. Over time, optimizing workloads for the cloud can reduce the load on your VMware infrastructure, reducing the licenses you need to maintain. The key is flexibility – by not relying solely on VMware for all infrastructure needs, you can adapt more easily to changes in cost structures. If Broadcom raises prices further, you can pivot additional workloads to other clouds with more control over costs.

In summary, a well-executed hybrid and multi-cloud strategy lets you avoid putting all your eggs in one basket. It increases your options for workload placement, potentially lowers costs, and ensures that VMware’s licensing changes do not derail your entire IT strategy.

Many CIOs are already moving in this direction as part of digital transformation – the Broadcom acquisition is simply an added reason to accelerate those plans.

The end state should be an IT landscape where VMware is one of several platforms used, employed where it makes sense, and not a monolithic dependency.

6. Engage Third-Party Service Providers and Resellers for Cost-Effective Solutions

In the wake of Broadcom’s changes, leveraging third parties – whether for support, licensing, or advisory services – can be extremely beneficial in controlling costs and ensuring service quality:

- Third-Party Support Providers: One immediate mitigation, especially for organizations with substantial existing VMware deployments, is considering third-party support for VMware products. Companies like Rimini Street and Spinnaker offer independent support services for VMware environments. These services can often save 30–40% in support costs compared to renewing support directly with Broadcom or VMware. Third-party support can cover updates, patches (sometimes even creating custom patches), and 24/7 technical assistance with VMware issues. The advantage is that you can continue using your perpetual licenses beyond the official support period without losing support coverage, effectively “buying time” if you’re not ready to migrate or subscribe immediately. Remember that third-party support may not provide new feature updates, but it will cover security fixes and resolutions. This path is especially useful if you plan to maintain your VMware versions for a few years while evaluating alternatives or waiting for budget approval. Many enterprises find third-party support a valuable bridge that keeps systems stable and supported at a lower cost while avoiding a rushed move to Broadcom’s subscriptions.

- Authorized Resellers and Service Partners: Although Broadcom has trimmed its partner network, elite VMware partners (Broadcom’s “Pinnacle” partners) and resellers still exist and can help navigate the new licensing. These partners often have deep VMware expertise and strategic relationships within Broadcom. Engaging a top-tier reseller or consulting partner can bring several benefits: they may offer advice on optimizing your license position, help co-create a transition plan, and, in some cases, provide better pricing or value-added services than dealing directly with Broadcom. For example, a global reseller might bundle VMware subscriptions with their managed services at a rate that eases the cost increase. They can also help ensure you fully understand all promotions or special programs. Verify if your current VMware partner has been onboarded into Broadcom’s new program and partner tier. If not, you may need to find a new partner highly accredited in Broadcom’s ecosystem who can assist you. These partners can advocate on your behalf and escalate issues within Broadcom, which is crucial in this new model, where direct communication can be challenging.

- Managed Service Providers (MSPs) and Cloud Vendors: Another angle is to offload some of the licensing burden through managed services. If you work with an MSP that provides VMware-based services, such as a hosted private cloud or VDI service, the MSP can handle the VMware licensing under their service agreement. You then pay for it as a service (often more friendly and possibly cheaper at scale), and the provider optimizes the licenses behind the scenes. Some cloud providers or colocation companies offer VMware-as-a-service, which involves bulk deals with VMware or Broadcom, allowing them to pass savings on to customers. Cloud-agnostic MSPs can also help design hybrid solutions that mix VMware and non-VMware technologies to lower costs. Essentially, by engaging third-party providers, you shift some responsibility of dealing with Broadcom onto them – leveraging their scale and expertise can yield cost benefits for you.

- Benchmarking and Licensing Advisors: If negotiating directly with Broadcom, consider using advisory firms or consultants specializing in software licensing. Firms experienced in VMware negotiations (and Broadcom’s tactics) can provide benchmark data and negotiation intel to inform your strategy. They might identify contract clauses to exploit or suggest creative deal structures. Some also offer license audit defense services to help if Broadcom initiates an audit, ensuring you don’t overpay on compliance findings.

Due diligence is important in all cases. Third-party support or services should be thoroughly evaluated for quality and risk. Ensure providers have solid VMware expertise (e.g., ex-VMware engineers on staff) and that any support contracts meet your business continuity requirements.

Engaging third parties is about being resourceful and tapping into external expertise and volume advantages you might not have on your own.

Many enterprises have found that a combination of third-party support for legacy environments and strong reseller partnerships for new purchases creates a competitive tension that ultimately saves money and yields better service than relying solely on the vendor.

7. Legal and Contractual Considerations

Finally, enterprises should not overlook the legal and contractual aspects of this transition.

As VMware customers move into new agreements under Broadcom, there are several considerations to keep in mind to protect your organization’s interests:

- Review Existing Contracts and Entitlements: Work closely with your legal team to review your current VMware contracts, Enterprise License Agreements (ELAs), and support terms. Determine the end dates of any support/Subscription (SnS) agreements and note any clauses related to renewals, price protections, or product use rights. For instance, some enterprise agreements may have had capped renewal increases – understand if Broadcom is honoring these or if the contract allows for termination. Since Broadcom announced the end of life for SnS renewals, ensure you identify any perpetual licenses that will lose support and document what you are entitled to. You maintain the right to use the software perpetually, even if support ends. If you have active support credits or prepaid funds (HPP/SPP credits), clarify how to use them before expiration.

- Plan the Transition of Contracts: If you decide to switch to new subscriptions, either in whole or part, determine how and when to make the transition. Broadcom and partners often recommend transitioning all perpetual licenses to subscriptions simultaneously to simplify the estate and have a single renewal date. While this can ease administration and assess the financial and operational impact, you may not want to give up valid remaining terms on some licenses early unless there’s compensation. Negotiate how your existing investments are carried forward. Additionally, ensure that any new subscription agreement includes acceptable terms regarding data center audits, true-up processes, and the flexibility to reduce licenses if your usage drops. Many subscription models allow downscaling at renewal but verify if this is the case with Broadcom.

- Address Data Protection and Compliance: A contractual angle often overlooked is data locality and compliance for cloud-connected offerings. If you adopt VMware Cloud Foundation subscriptions, confirm how the licensing checks or telemetry operate. Ensure that your compliance requirements handle any data Broadcom collects about your usage. Additionally, if you are subject to regulations, ensure the contract addresses the continued support of older versions, if needed, for validation purposes, or that third-party support is an option written into it.

- Consider Legal Remedies or Regulatory Action: In extreme cases, you might explore legal avenues if your organization believes Broadcom’s actions violate antitrust or contractual commitments. (Notably, some European customers have escalated grievances to EU regulators, claiming Broadcom’s tying of products and abrupt changes constitute anti-competitive behavior.) While pursuing litigation or complaints is a last resort, not a short-term solution, awareness of these actions is useful. At the very least, it underscores the importance of documenting all communications and promises made by VMware/Broadcom during the transition. Has your legal counsel been involved in major negotiations to ensure any commitments (e.g., specific pricing, feature roadmaps, support levels) are written into the contract?

- Intellectual Property and Exit Clauses: If you are engaging alternative providers or support, ensure there are no contract clauses that would penalize you. VMware’s standard EULA generally permits third-party support (since you own the license), but just be mindful of clauses about reverse engineering or modifications if a third party provides patches. When signing new agreements, try to include an exit clause or flexibility – for example, the right to terminate subscriptions for convenience after a certain period or conversion rights to different products if your strategy changes. Given the dynamic situation, having contractual wiggle room is valuable.

In summary, treat this as a legal renegotiation of your relationship with VMware.

Loop in procurement and legal teams early to scrutinize Broadcom’s proposals and update your internal software asset management policies under this new model.

By being contractually savvy, you can avoid locking into unfavorable terms that could come back to haunt you later.

In a time of such change, the contract is your safeguard; ensure it reflects your enterprise’s needs for cost predictability, quality support, and strategic flexibility.