SAP S/4HANA Licensing Models

SAP S/4HANA Cloud is SAP’s flagship cloud ERP, and its licensing model marks a significant shift from traditional on-premise SAP licensing.

CFOs and CIOs must understand how S/4HANA Cloud’s subscription licensing works, how costs are calculated, and what financial implications to expect.

This guide provides an enterprise-focused overview of S/4HANA Cloud licensing, covering the available licensing models (such as RISE with SAP and the Full Usage Equivalent metric), how user counts and metrics are determined (and how they differ from ECC on-premise licensing), global pricing benchmarks in USD, and strategic considerations.

Licensing Models in SAP S/4HANA Cloud

SAP S/4HANA Cloud is offered strictly as a cloud subscription (public or private edition), using a SaaS model – no traditional perpetual licenses or on-premise pricing apply.

Key licensing models include:

- RISE with SAP: An all-inclusive subscription bundle that packages S/4HANA Cloud (available in Public and Private editions) with infrastructure, technical managed services, and additional cloud services. RISE is sold as a subscription contract (typically with a 3-5 year term) that includes a monthly or annual fee covering the ERP software license, cloud hosting (on SAP’s or a hyperscaler’s data center), maintenance, and support. It often includes extras like SAP Business Technology Platform credits, Business Network starter packs, and SAP Signavio tools. RISE aims to simplify contracts by acting as “one offer, one contract” for the full cloud ERP stack, making costs predictable and reducing the need for separate agreements for databases or hardware. Large enterprises adopting S/4HANA Cloud frequently choose RISE with SAP for convenience and promised TCO benefits.

- Subscription Licensing (Standalone S/4HANA Cloud): Customers can license SAP S/4HANA Cloud without the full RISE bundle. In this model, an organization subscribes to S/4HANA Cloud (Public Edition or Private Edition) as a software service but may handle or contract the infrastructure and management separately. The licensing for the software still uses the same subscription metric, measured in Full Usage Equivalents (explained below). SAP has introduced programs like GROW with SAP for mid-market customers, providing S/4HANA Cloud Public Edition in a simplified package outside of RISE. Large enterprises that are not using RISE may negotiate subscription terms for S/4HANA Cloud directly (for example, if they prefer to manage their cloud infrastructure independently or through a preferred partner). In any case, the license metric and subscription approach remain consistent.

Focus on Cloud Editions:

It’s important to note that this guide focuses strictly on S/4HANA Cloud licensing.

The on-premise S/4HANA licensing (perpetual licenses, named users, engine metrics) is not covered here, except where we highlight differences for context.

In S/4HANA Cloud, whether via RISE or standalone, licenses are subscription-based and measured primarily by users and usage metrics, rather than by CPU cores or server size (although environment size can influence cost tiers – more on this in the TCO section).

S/4HANA Cloud subscriptions typically come in two flavors:

- Public Cloud Edition (Multi-Tenant): A standardized SaaS offering where SAP fully manages infrastructure, and updates are frequent. Licensing is typically slightly lower in cost per user than the private edition, due to economies of scale and reduced customization requirements.

- Private Cloud Edition (Single-Tenant): A dedicated instance for the customer managed by SAP or a partner (often under the RISE offering). This allows for more customization and flexibility (similar to on-premises capabilities), but generally comes at a higher subscription cost than the public edition.

Both editions use the same licensing metric (FUE and user types), but RISE with SAP contracts often bundles additional services on top.

Companies should choose the model that fits their strategic needs—RISE’s bundled approach versus standalone subscriptions—but in either case, understanding the user licensing metric is crucial.

Full Usage Equivalents (FUE) – How Cloud Licensing Works

SAP S/4HANA Cloud introduced the Full Usage Equivalents (FUE) concept to simplify user licensing.

Instead of purchasing separate license types for each user category (as one did in SAP ECC), customers purchase several FUEs, which can be allocated across different user role types.

Each FUE represents a “full use” of the system, and lighter-use roles count as a fraction of an FUE. This model allows assigning and reassigning users without continually adjusting the contract for each role change.

Here’s how it works:

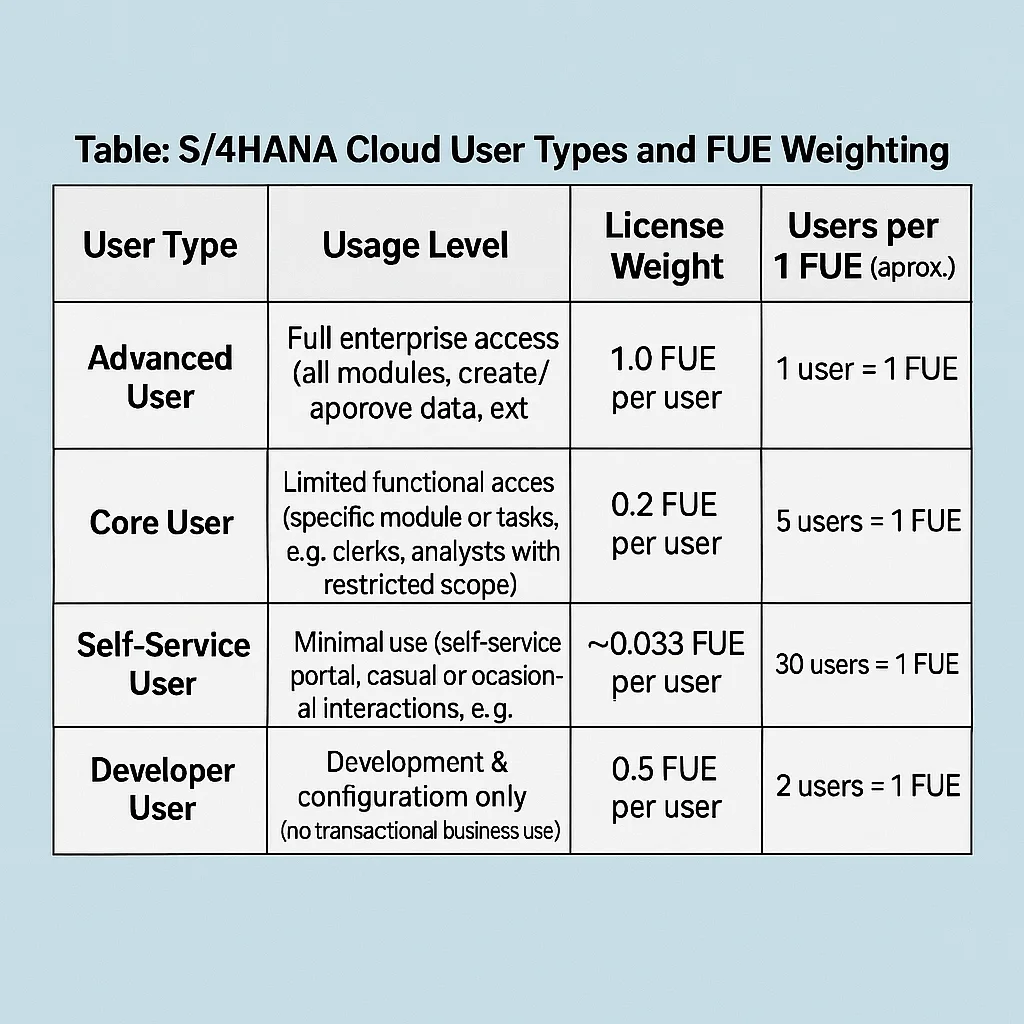

- User Categories and Weightings: S/4HANA Cloud defines several user types, each with a weighting factor determining how many users equal 1 FUE. The main categories are:

- Advanced Use – Full business user with broad access (analogous to a “professional user”). Weighting 1.0, meaning 1 Advanced User consumes 1 FUE.

- Core Use – Limited or functional user with access to specific standard tasks (think of someone who carries out routine transactions in a specific module but doesn’t need enterprise-wide capabilities). Weighting 0.2, meaning 5 Core Users = 1 FUE.

- Self-Service Use – Occasional users or employees who only perform light tasks (e.g., timesheet entry, expense approvals, basic self-service inquiries). Weighting ~0.033, meaning 30 Self-Service Users = 1 FUE.

- Developer Access—Users in development or system configuration roles. Not all customers will have developers on the system, but these roles are counted if they do. Developer users have a lighter footprint, weighing 0.5, so 2 Developers = 1 FUE (developers typically don’t execute business transactions, hence they count less than a full user).

- Allocation Flexibility: You buy a pool of FUEs (for example, 100 FUEs) rather than specific counts of each user type. Within that pool, you can allocate users in any combination if the weighted total stays within your purchased FUE count. For instance, if you have 50 advanced users (50 FUEs), 100 core users (100 * 0.2 = 20 FUEs), and 300 self-service users (300 * 0.033 = ~10 FUEs), your total consumption is ~80 FUEs out of 100 purchased within your entitlement. This flexibility allows you to adjust user roles over time (e.g., if some users’ needs grow, you can grant them advanced access and, correspondingly, reduce some other heavy roles) without needing to purchase additional licenses immediately, as long as you have spare FUE capacity. Reallocation is allowed during the subscription term: companies can periodically reassign FUEs to different use types as employees change roles or usage patterns. This helps avoid “shelfware” (paid-for licenses not being used) – a common issue in the old static named-user model.

- Minimum Purchases and Scaling: SAP often requires a minimum commitment of FUEs to start an S/4HANA Cloud subscription. For example, a standard RISE with SAP S/4HANA Cloud contract typically has a minimum of 35 FUEs (which can cover a small footprint of users). In contrast, a private edition deployment may have a higher minimum, such as 40 FUEs. This ensures a baseline revenue for SAP and that the customer environment is sized adequately. As the organization grows in usage, it can purchase additional FUEs in blocks. Contracts typically define tiers for volume discounts, with larger FUE purchases resulting in a lower cost per FUE. (For instance, an enterprise with 2,000 users might pay a lower rate per FUE than 100 users.)

Table: S/4HANA Cloud User Types and FUE Weighting

| User Type | Usage Level | License Weight | Users per 1 FUE (approx.) |

|---|---|---|---|

| Advanced User | Full enterprise access (all modules, create/approve data, extensive functionality) | 1.0 FUE per user | 1 user = 1 FUE |

| Core User | Limited functional access (specific module or tasks, e.g. clerks, analysts with restricted scope) | 0.2 FUE per user | 5 users = 1 FUE |

| Self-Service User | Minimal use (self-service portal, casual or occasional interactions, e.g. employees entering time or viewing payslips) | ~0.033 FUE per user | 30 users = 1 FUE |

| Developer User | Development & configuration only (no transactional business use) | 0.5 FUE per user | 2 users = 1 FUE |

Note: The FUE ratios above indicate that one Advanced user “costs” the full 1 FUE, whereas one Self-Service user has a significantly lower impact (30 of them equal 1 FUE).

SAP’s licensing abstracts these details – you simply commit to a certain number of FUEs and then internally manage the number of users of each type.

The system or your SAP contract administrator will ensure you stay in compliance (by monitoring user role assignments to ensure the weighted sum doesn’t exceed your FUE entitlement).

Companies will analyze their user population and categorize users into these groups during the planning phase. For example, a company might find that 15% of users need Advanced access, 50% can access Core, and 35% can access Self-Service.

This mix will determine the number of FUEs to purchase. A helpful strategy is to slightly overestimate FUE needs to allow for growth but also regularly review usage so you can downgrade some users’ access levels if they don’t require full functionality (improving cost efficiency).

SAP and its partners provide tools to map your current SAP user licenses to FUEs as part of the migration planning process.

How S/4HANA Cloud Licensing Differs from SAP ECC

For organizations transitioning from SAP ECC (the on-premise ERP), the licensing approach in S/4HANA Cloud has notable differences.

Understanding these differences is crucial for financial planning and compliance management:

- Named Users vs. Subscription Users: In ECC (on-premise), you purchased perpetual named-user licenses for each individual (with types like Professional, Limited, Employee, etc.), plus additional “engine” licenses for certain functionality. You paid a one-time license fee and then ~20% of that amount per year for support and maintenance. In S/4HANA Cloud, there are no perpetual license sales – instead, you subscribe to the software. Users are counted via the FUE model described above rather than fixed named-user counts by type. This means greater flexibility and ongoing payments as long as you use the service (an OpEx model).

- Metric Simplicity: ECC licensing may involve various metrics, such as user counts, processing capacity, or transactions (for engines). S/4HANA Cloud largely consolidates pricing into the user-based metric. For core ERP, you typically won’t be separately charged by transaction volumes or database size, except if you exceed certain thresholds tied to your subscription tier. (Under RISE, the infrastructure sizing – sometimes referenced by “T-shirt sizes” like S, M, L systems based on FUE count – ensures your cloud hardware capacity matches your user subscription. Extremely high data volume or extra environments might incur additional fees, but these are part of the cloud service agreement rather than separate license add-ons.) HANA database licenses are included in S/4HANA Cloud subscriptions (unlike on-prem, where a separate HANA DB license was required). Similarly, standard modules of S/4HANA (such as finance and logistics, under the “Enterprise Management” scope) are bundled into the base cloud subscription, whereas ECC requires licensing each module or component individually in many cases.

- Updates and Upgrades: In on-premises ECC, upgrades to new versions were optional and at the customer’s discretion (often requiring a new license for the new product, such as S/4HANA, or just a technical upgrade under maintenance). With S/4HANA Cloud, continuous updates are included in the subscription. SAP pushes regular updates (for public editions, quarterly feature updates, and private editions, yearly or as contracted) to keep the software current. New versions have no separate license fee – it’s all part of the service. This shifts the cost consideration: instead of large periodic upgrade projects, CFOs should plan for smaller, ongoing testing and change management costs to absorb continuous innovation.

- Support Costs: ECC annual support (15-22% of license price) was a recurring expense. In S/4HANA Cloud, support (at least standard support) is typically baked into the subscription fee – you don’t pay a separate maintenance invoice. However, SAP has been known to increase cloud fees or support tiers over time. For example, SAP announced annual support price increases (e.g., 5% in 2024) affecting cloud subscriptions and support. So, while you avoid the classic maintenance contract of on-prem, similar cost escalators may apply via subscription price hikes upon renewal. Contracts might fix prices for the term, but CFOs should anticipate inflationary uplifts when renewing multi-year deals.

- Contract Flexibility and Commitments: On-prem licenses, once bought, were assets on the books (CapEx) and could be used indefinitely (with the option to pay maintenance for upgrades and support). Cloud licenses are pure OpEx – you pay to access software for the duration of the contract. If you stop paying, you lose access. This makes it easier to scale down if needed (in theory, you could reduce user count in a renewal if your workforce shrinks, something not possible after buying perpetual licenses). Still, it also means long-term commitment needs to be managed. SAP often requires a minimum 3-year subscription term for S/4HANA Cloud contracts, such as RISE. Early termination can incur penalties. From a financial standpoint, the expense moves from the depreciation of a one-time license purchase to a recurring subscription line item. This can impact EBITDA and budget planning but also provides more predictable annual costs.

- Indirect/Digital Access: In ECC, a contentious issue was indirect access (e.g., when third-party or non-SAP systems create transactions in SAP, requiring additional document licenses). In S/4HANA Cloud, licensing is generally user-based, which simplifies concerns about indirect usage. If external systems interface with S/4HANA Cloud via APIs, as long as they’re doing so in the context of a named user or service user that’s licensed, there isn’t an extra “digital access” license fee. SAP has indicated that digital access charges are mainly an on-prem concern; cloud contracts tend to cover typical scenarios. However, CFOs and CIOs should still review their cloud agreement to ensure no transaction or API volume limits are being exceeded. Generally, S/4HANA Cloud shifts the model to an authorization-based licensing approach (who is authorized to use the system), rather than the traditional transaction counting. This can reduce the occurrence of surprise bills, but you must ensure that every human or system accessing the ERP is covered by an FUE allocation.

Table: SAP ECC vs. S/4HANA Cloud – Key Licensing Differences

| Factor | SAP ECC (On-Premise) | SAP S/4HANA Cloud |

|---|---|---|

| License Model | Perpetual licenses (CapEx) + annual maintenance (20%); one-time purchase of user and module licenses. | Subscription service (OpEx) – pay-as-you-go for the term. No separate maintenance contract (support included in subscription). |

| User Metric | Named Users by type (e.g. Professional, Limited, Employee) – fixed count per type. Additional “engine” metrics for certain functionality (e.g. SAP Payroll by employee count). | Full Usage Equivalents (FUE) – aggregated user metric. Users categorized into Advanced/Core/Self-Service roles which convert into FUEs. No separate engine licenses for core ERP features; most functionality covered by base subscription (some specialized add-ons possible). |

| Infrastructure & DB | Customer-provided hardware and database. If using SAP HANA, a separate HANA license purchased. Customer manages upgrades, patches, and downtime. | Cloud infrastructure included (SAP or hyperscaler). HANA database license included. SAP manages the system availability, backups, and updates as part of service (with SLA commitments). |

| Upgrades & Updates | Major version upgrades optional, often requiring new installation or migration (e.g. ECC to S/4). Minor support packs applied by customer. Upgrades may incur additional services cost, but license is perpetual. | Continuous improvement model – regular updates are pushed by SAP (no additional license cost). Customer must adapt to new features but benefits from always-current software. No separate license for moving to next version, since subscription covers it. |

| Cost Visibility | Upfront license cost can be capitalized; ongoing maintenance fees and infrastructure costs are separate. Total cost spread across license, hardware depreciation, support, internal IT operations. | All-in-one subscription fee covers software and standard support/infrastructure. Easier to predict annual costs, though implementation and integration are separate project costs. Often less internal IT overhead for infrastructure (outsourced to SAP). |

| Scalability | Adding users requires purchasing new licenses (CapEx); reducing users doesn’t recover cost (licenses once bought are sunk cost). Scaling hardware requires new capital outlay. | Add or remove users by adjusting subscription (usually can increase mid-term; decreases often only at renewal). More flexibility to scale environment size via the cloud provider. Contracts may have minimums or allow some buffer capacity. Overall, scaling is more elastic in cloud, but costs scale linearly with users. |

In summary, moving to S/4HANA Cloud changes the nature of your SAP investment from a capital expenditure to a service subscription.

It simplifies certain aspects (such as not having to juggle different license types for each module or worrying about hardware). Still, it introduces new considerations, such as managing the FUE allocations and ensuring you negotiate favorable terms for a recurring commitment.

Pricing Benchmarks and Cost Components

Understanding the cost structure of SAP S/4HANA Cloud is critical for budgeting.

While exact pricing is highly customer-specific (varies by the number of users, edition, contract length, and discounts negotiated), there are publicly noted benchmarks and typical ranges that CFOs can use for planning:

- Per-User Subscription Costs: For full Advanced Users (i.e., those who consume 1 FUE each), list prices generally range from approximately $150 to $250 per user per month. For example, some licensing advisories cite a basic S/4HANA Cloud user subscription at approximately $180 per user per month for core ERP access, and an advanced user subscription at $250–$300 per user per month for broader functional access. These figures represent list prices; enterprise customers often negotiate significant discounts based on volume (number of users) and multi-year commitments. Large deals are not uncommon in achieving lower effective per-user rates (e.g., under $150 per month per advanced user) due to these discounts.

- Light User Costs: Thanks to the FUE model, users with limited roles incur proportionally lower costs. A Core user might effectively cost one-fifth of an advanced user. In monetary terms, if an advanced user is approximately $200 per month, a core user might be roughly $40 per month on a pro-rated basis. Self-service users are even cheaper per head, on the order of only a few dollars per month (since 30 self-service = 1 full user). For instance, 30 self-service employees might collectively cost approximately $200 per month (equivalent to $6-7 per user). This makes it economically feasible to license the entire employee base for self-services if needed, without blowing the budget. The exact prices will depend on the contracted FUE rate. Still, CFOs can expect that not all users are equal in cost; heavy operational users carry the bulk of the subscription cost, whereas occasional users add minimal incremental costs. Getting the right mix is important: you wouldn’t want to pay for all users as if they were advanced if many only need self-service. This is where carefully designed roles can save money.

- RISE with SAP Bundle Pricing: When reviewing RISE contracts, SAP typically prices the entire bundle based on FUEs and any additional options. As a rough benchmark, a RISE with SAP Public Cloud subscription can cost roughly $150 per FUE per month (this figure can drop at higher volumes). Private Edition RISE may be higher – e.g., on the order of $170–$180 per FUE per month – because it includes dedicated infrastructure. For example, if a company requires 100 FUEs for its users, a public edition subscription might list at approximately $15,000 per month (100 * $150). In contrast, a private edition for the same FUEs could cost approximately $17,000–$18,000 per month. Note that these are indicative and subject to negotiations; SAP’s pricing tiers mean the per-FUE rate improves for larger user counts. Large enterprises (thousands of users) will negotiate custom pricing, possibly well below the list price. Global enterprises often end up with S/4HANA Cloud subscription deals worth multi-million USD annually. For instance, a company with 10,000 employees on S/4HANA Cloud might have a contract of $10–20 million per year, depending on the user mix and discount, whereas a mid-sized firm with 200 users might spend a few hundred thousand dollars per year.

- Cost Components Included: What exactly are you paying for with S/4HANA Cloud’s subscription? Primarily:

- The software license for S/4HANA (covering the digital core ERP functionality).The infrastructure and technical operation (SAP’s cloud or hyperscaler fees to host your systems, monitor, back up, etc.).Support services (usually standard support is built-in; higher support tiers might cost extra).Continuous improvement (the R&D cost of enhancements is effectively included, as you get new features regularly).

- If you need additional SAP products integrated (like SAP Ariba, SuccessFactors, etc.), they are separately licensed cloud solutions.

- Some line-of-business or industry packages in S/4HANA (e.g., advanced capabilities for Retail, Automotive, etc.) may come as add-on subscriptions on top of the base “Enterprise Management” license. Be sure to clarify if any module you require isn’t in the base scope and factor that cost into it.

- Under RISE, you often get some SAP BTP (platform) credits. Using beyond the included credits or extra cloud services (machine learning services, IoT, etc.) can incur consumption-based charges in addition to the core subscription. CFOs should watch these variable costs, as they can be the “Azure/AWS-style” usage fees in the SAP ecosystem.

- Extensions and partners: If you deploy third-party add-ons from SAP’s cloud marketplace or use SAP-approved partner extensions, their subscription fees may be separate from S/4HANA Cloud.

- Total Cost of Ownership (TCO): SAP often markets that S/4HANA Cloud (especially via RISE) can reduce TCO by ~20% compared to on-prem, by consolidating costs and increasing efficiency. While there are TCO advantages (no hardware refreshes, lower internal IT overhead for system maintenance, and included upgrades), CFOs should perform their own TCO analysis:

- Include implementation and migration costs in year one (which can rival or exceed the first year’s subscription fee – implementation can cost 1x-2x the annual software cost,

- Pricing Example: For simplicity, consider a company requiring 100 Advanced users, 200 Core users, and 300 Self-service users on S/4HANA Cloud Public Edition. That equates to 100 FUE (from advanced), 40 FUE (from core, since 200/5), and 10 FUE (from self-service, 300/30), totaling 150 FUE. If the negotiated price were $160 per FUE per month (a mid-range enterprise discount), the monthly subscription would be $24,000, which is approximately $288,000 per year. This covers 600 users at various usage levels. By contrast, an on-premises equivalent might have been, for example, a $1.5M upfront license plus $ 330,000 annual maintenance, plus infrastructure and upgrade costs – depending on the circumstances. The cloud subscription could be similar in annual cash outlay, but without the upfront capital hit. Each enterprise’s figures will differ, but this example gives a sense of scale and how user counts drive subscription costs.

- Contractual Notes: Globally, SAP’s pricing is often quoted in USD for consistency, though local deals might be in EUR or other currencies. Ensure that you clarify the currency and any exchange rate provisions if you operate globally. Also, pay attention to whether the contract includes price escalation clauses – many cloud contracts have an annual increase (typically 3% per year) built in, or a cap on increases at renewal. Negotiate these to avoid unwelcome surprises. Additionally, check if your contract allows you to flex the user count up or down. Some customers negotiate the right to reduce the FUE count by a small percentage at renewal if not needed (although SAP’s standard approach is that usage can be increased at any time, but reductions are only allowed at renewal and usually not below the initial committed level).

Strategic Considerations for CFOs and CIOs

Licensing an enterprise ERP in the cloud is not just an IT decision – it’s a financial and operational strategy.

Here are key considerations and impacts for CFOs and CIOs:

- Budgeting & Financial Impact: Moving to S/4HANA Cloud turns what might have been a large capital purchase (an asset on the balance sheet) into an ongoing operating expense. CFOs should consider how this aligns with the company’s financial strategy. The subscription model can be beneficial for cash flow management and avoiding large spikes in spending, but it does lock the company into continuous payments. Ensure that the multi-year subscription cost is planned for in long-term budgets and that the ROI is clear (e.g., through improved efficiency or IT cost offset elsewhere). The predictability of a subscription (fixed annual fees) can aid budgeting. However, note that stopping or pausing the spending isn’t possible without losing the system, which increases dependency on SAP.

- Contract Negotiation and Flexibility: CFOs and CIOs should collaborate to negotiate a contract that provides flexibility and safeguards against potential risks. This includes user count flexibility (can you adjust the FUE count if your user base changes significantly?), growth terms (pricing for adding more users or additional SAP cloud services in the future), and renewal protections (caps on price increases, options to extend at similar terms). Since S/4HANA Cloud will likely be a cornerstone system, lock in as much value as possible upfront. Enterprise agreements with SAP sometimes allow for swapping or converting unused licenses. Clarify if your FUEs can be repurposed. If you add other SAP cloud products, do you receive any bundled discount?

- Legacy License Asset Management: If you are a SAP ECC customer, consider the implications for your existing licenses. Often, once you have fully migrated to S/4HANA Cloud, you may eventually terminate maintenance on ECC (after the migration is complete), and those perpetual licenses become obsolete. SAP has offered license conversion programs, where the residual value of on-premises licenses and maintenance can offset cloud subscription costs. CFOs should maximize this by timing the move to avoid paying maintenance and subscription fees for an extended period, and by negotiating credits for the value of what they have already purchased. The CFO will also need to assess any write-off of capitalized software if decommissioning on-prem licenses (though many may be fully depreciated by now, depending on age).

- Total Cost and Value Analysis: CFOs will want to ensure the move to S/4HANA Cloud is financially justified. Beyond the raw subscription fees, consider the total cost of running ERP under this model:

- Reduced infrastructure and IT operations costs (data center, hardware maintenance, database admin effort) – these should be quantified as savings.

- Avoided upgrade costs: In an on-prem world, a major version upgrade could cost millions in project spending every few years. In the cloud, those costs are replaced by smaller, continuous improvement efforts. Ensure the organization is prepared to absorb that (training, testing, and change management each quarter and that it costs less than a big-bang upgrade.

- Impact on business continuity and risk: SAP takes on much of the responsibility for uptime and security in the cloud model, potentially reducing the risk of outages and security incidents (which have financial impacts). On the other hand, vendor dependency risk increases if SAP experiences an outage or the contract encounters issues, you have less direct control. Mitigating this with clear SLAs and governance is key.

- Opportunity for process improvement: S/4HANA (especially the latest cloud version) brings new capabilities (AI, analytics, automation). The value gained from these improvements (faster closing cycles, better inventory optimization, etc.) can be part of the business case that justifies the subscription cost. CIOs should map out these benefits and ensure they are realized post-implementation, as this will help CFOs see a return on the ongoing subscription fees.

- Operational Governance: CIOs must implement governance around user licensing in the cloud. While you don’t have to manage as many license keys and installations, you do need to manage user access rights carefully. Why? The roles assigned to users determine whether they count as Advanced, Core, or Self-Service. If you inadvertently give too many people Advanced roles, your FUE consumption might spike beyond what was planned. Regular reviews of user roles and authorizations become a cost control measure. Tools for license monitoring and optimization (including SAP’s analysis tools or third-party Software Asset Management solutions) are valuable. The IT and finance team should partner to periodically true-up FUE usage and ensure you’re within your licensed amount or plan for an increase if business growth demands it.

- Compliance and Audit: SAP can audit your usage even in the cloud. If you consistently exceed your FUE count, SAP will require you to purchase more. It’s wise to proactively manage compliance to avoid unexpected bills. One difference from on-prem is that the cloud system usage is more transparent to SAP (since they operate the service). This makes compliance enforcement easier for SAP, so companies should be diligent. The CFO should ensure minimal compliance risk by having the right number of licenses and monitoring indirect usage. The CIO should ensure no technical workarounds inadvertently allow unlicensed access (for example, sharing accounts, which is against SAP policy and would skew user counts).

- Benchmarking and Cost Management: Given the substantial cost of S/4HANA Cloud subscriptions, enterprises should benchmark their deal against those of their peers or industry standards. Some consulting firms and user groups provide anonymized benchmarks (e.g., cost per user or FUE for similar-sized installations). CFOs might use these to negotiate better terms with SAP. Additionally, plan for cost optimization reviews: as seen in some cases, optimizing user license types can save 20-30% of FUEs. After going live, review to see if some Advanced users only use limited functionality and could be downgraded to Core, etc. Those adjustments at renewal time can yield significant savings.

- Scenario Planning: Strategically, CFOs and CIOs should consider future scenarios:

- If the company grows rapidly (either organically or through M&A), how will S/4HANA Cloud licensing scale? Ensure the contract can accommodate adding many users at a reasonable incremental cost.

- Conversely, if a divestiture or downturn happens, are you stuck overpaying for unused capacity until the contract ends? Try to build some agility or, at the very least, short renewal cycles to adjust.

- The 2027/2030 ECC end-of-support deadline is pushing many to S/4HANA. SAP knows this, and pricing leverage may change as those dates near. Being early vs. late might affect negotiating power. Also, consider the risk of staying on ECC beyond maintenance. SAP is increasing maintenance fees (annual 5% hikes), which narrows the cost gap with the cloud. CFOs should weigh the rising cost of “doing nothing” against the cost of moving to the cloud.

- Geographical and Regulatory Considerations: If you operate in multiple regions, consider how SAP’s cloud data center locations and access provisions meet your needs (this could be relevant if, say, data residency requires a specific region – sometimes a specific region’s S/4 cloud might cost differently or require a particular contract structure). Also, factor in the cost of local taxes or VAT on cloud services.

In essence, S/4HANA Cloud licensing is not just a technical detail – it’s a strategic component of your IT finance planning.

CFOs will want to ensure the subscription yields continuous value. CIOs must ensure the organization fully leverages what it’s paying for (e.g., using included tools, staying on top of new features that could improve processes).

Recommendations

To wrap up, here are concrete recommendations for CFOs and IT leaders as they evaluate or manage SAP S/4HANA Cloud licensing:

- Thoroughly Assess License Needs: Before signing a contract, analyze your user base and categorize users into Advanced, Core, Self-Service, etc. Use your current SAP usage data (if coming from ECC) or conduct workshops to estimate how many users need which level of access. Right-size the FUE count so you’re not buying significantly more than required, but also account for future growth. An upfront license assessment can identify opportunities to optimize (for example, reducing unnecessary high-level access), directly lowering subscription costs.

- Leverage Conversion Incentives: If migrating from on-prem, work with SAP to apply the value of your existing investments. Many companies can negotiate credits or migration discounts (such as recognizing unused on-prem license value or substituting maintenance payments into cloud fees). Ensure any RISE with SAP offer includes incentive pricing that makes financial sense compared to staying on maintenance for a few more years.

- Negotiate Contract Terms Aggressively: Don’t accept the first quote. Negotiate volume discounts, contract length, and flexibility. For a large enterprise, multi-year SaaS deals can often be negotiated for 30-50% off list price or more. Also, push for terms like fixed pricing (no hidden escalators) and the ability to true-up or adjust if business conditions change. Ensure the contract spells out how adding users or extra FUEs will be priced (e.g., locking in a price tier for additional users can avoid a costly surprise later).

- Understand What’s Included (and Not): Clarify the scope of your S/4HANA Cloud subscription. Confirm which modules and processes are covered under the base license. Identify any add-ons you might need (e.g., advanced planning, extended warehouse, industry-specific functions) and get pricing for those upfront or include them if critical. If RISE includes ancillary components like BTP credits or Business Network access, ensure you plan to use them; otherwise, you leave value on the table. Conversely, if some included components aren’t needed, see if removing them yields a better price.

- Plan for Implementation and Beyond: Budget for the implementation costs (systems integrator, data migration, training) and consider them alongside subscription fees when calculating ROI. S/4HANA Cloud might reduce ongoing IT costs, but initial investment in a successful deployment is significant. CFOs should ensure that project costs (which can be capitalized in many cases) are separated from subscription costs in financial plans. After going live, invest in change management and continuous improvement. Since you’re paying for quarterly innovations, set up a process to evaluate new features regularly and adopt those that add value (so the organization benefits fully from the subscription).

- Optimize and Monitor Usage: Treat license usage optimization as an ongoing process. Post go-live, CIOs should put in place quarterly or semi-annual license reviews. Monitor FUE consumption: If it’s well below what you purchased, you might be able to accommodate more users or negotiate a renewal reduction. If it’s creeping up, address whether that’s due to genuine business growth or overly broad role assignments. Use SAP’s tools or external Software Asset Management solutions to track user activity and ensure the license assignment matches actual usage. This avoids compliance issues and controls costs by identifying opportunities (e.g., perhaps 100 users assigned as Advanced only use the system minimally – consider switching them to Core where possible).

- Educate Stakeholders on Licensing Impact: Make sure your IT administrators and business role owners understand that giving someone additional access isn’t free—it could change their user category. Building awareness of the impact of licensing on user provisioning processes will help avoid inadvertent over-allocation. For example, have governance that approves when someone is made an “Advanced” user versus a “Self-Service” user, with cost impact in mind. This way, line managers and project teams consider license costs as part of the user setup.

- Benchmark and Seek Expert Advice: Given the complexity and high stakes, consider using SAP licensing experts or negotiators to benchmark your deal. Peer benchmarks can provide confidence that you’re getting a competitive rate. If you lack internal expertise in SAP contracts, engaging an independent advisor during negotiations can often pay for itself via improved discounts or terms. Additionally, join SAP user groups or networks where CFOs and CIOs share experiences – learning from others who have moved to S/4HANA Cloud can reveal hidden challenges or cost drivers to prepare for.

- Align Licensing with Strategic Roadmap: Ensure your SAP S/4HANA Cloud licensing aligns with your company’s strategic roadmap if you plan to roll out new subsidiaries on S/4; factor that into user counts now. If you foresee a shift (like more automation, which might reduce human users, or conversely, an acquisition that doubles users), discuss these scenarios with SAP to understand how they’d be handled. A well-structured contract can accommodate change without punitive costs. For example, you might negotiate a clause that allows an increase of X% in users at the same per-FUE rate, should an acquisition occur. Thinking ahead will save headaches later.

By following these recommendations, CFOs and CIOs can better manage the financial and operational aspects of SAP S/4HANA Cloud licensing, ensuring that the organization gets the best value and faces no surprises in its cloud ERP journey.

Read about our SAP License Management Services.